Writing an auto insurance cancellation letter is a key step in formally ending your policy. Make sure to include all necessary information, keep the letter concise and clear, and follow up with the insurance company to confirm cancellation.

One of the essential tasks when it comes to managing your auto insurance policy is understanding how to write an auto insurance cancellation letter. It might seem like a daunting task, but with the right guidance, you can navigate through the process smoothly. In this blog post, we will walk you through the ins and outs of crafting a well-written auto insurance cancellation letter.

What is an Auto Insurance Cancellation Letter?

An auto insurance cancellation letter is a formal written document addressed to your insurance provider, informing them of your decision to terminate your auto insurance policy. This letter serves as proof that you have taken the necessary steps to cancel your coverage.

- It is important to include specific details such as your policy number, the effective date of cancellation, and your reasons for discontinuing the policy.

- The letter should be concise, clear, and professional in tone to ensure that the cancellation process goes smoothly.

Why Do You Need to Write an Auto Insurance Cancellation Letter?

Writing an auto insurance cancellation letter is crucial for several reasons:

- It serves as a record of your request to cancel the policy, protecting you from potential disputes in the future.

- It helps you avoid any unnecessary charges or fees that may arise if the cancellation process is not properly documented.

- It allows you to formally communicate with your insurance provider, ensuring that both parties are aware of the cancellation.

How to Write an Auto Insurance Cancellation Letter

When writing an auto insurance cancellation letter, follow these steps to ensure that your letter is well-structured and comprehensive:

- Begin with a Proper Salutation: Address the letter to the appropriate contact person at your insurance company.

- Provide Your Policy Information: Include your policy number, the effective date of cancellation, and any other relevant details.

- State Your Reasons for Cancellation: Clearly outline why you have decided to cancel your auto insurance policy.

- Request Confirmation: Ask for confirmation of the cancellation in writing to ensure that the process is completed.

- Express Gratitude: Thank the insurance company for their services and cooperation throughout the policy period.

Sample Insurance Cancellation Letter Template

Here are few Insurance cancellation letter samples:

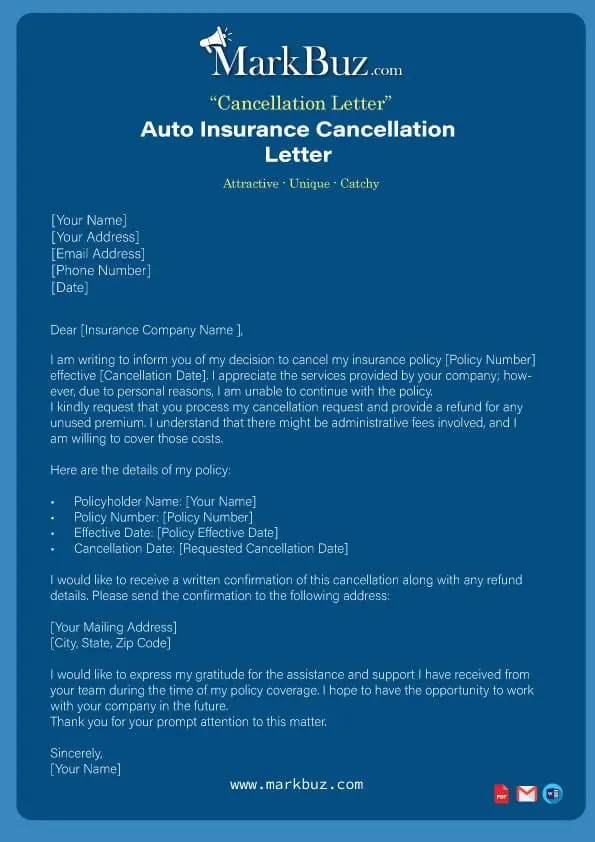

Example 1:

[Your Name]

[Your Address]

[Email Address]

[Phone Number]

[Date]

Dear [Insurance Company Name],

I am writing to inform you of my decision to cancel my insurance

policy [Policy Number] effective [Cancellation Date]. I appreciate

the services provided by your company; however, due to personal

reasons, I am unable to continue with the policy.

I kindly request that you process my cancellation request and

provide a refund for any unused premium. I understand that there

might be administrative fees involved, and I am willing to cover

those costs.

Here are the details of my policy:

Policyholder Name: [Your Name]

Policy Number: [Policy Number]

Effective Date: [Policy Effective Date]

Cancellation Date: [Requested Cancellation Date]

I would like to receive a written confirmation of this cancellation

along with any refund details. Please send the confirmation to the

following address:

[Your Mailing Address]

[City, State, Zip Code]

I would like to express my gratitude for the assistance and support

I have received from your team during the time of my policy coverage.

I hope to have the opportunity to work with your company in the future.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

Example 2:

[Your Name]

[Your Address]

[Email Address]

[Phone Number]

[Date]

Dear [Insurance Company Name],

I am writing to formally request the cancellation of my auto

insurance policy with [Insurance Company Name]. Please consider

this letter as a formal notice of my intent to cancel my policy

effective [date you want the cancellation to be effective], in

accordance with the terms and conditions outlined in the policy

agreement.

Details of the policy: Policyholder Name: [Your Name] Policy Number:

[Your Policy Number] Vehicle Information: [Make, Model, Year, VIN]

Effective Date of Policy: [Effective Date]

I am requesting the cancellation of my auto insurance policy due to

[reasons for cancellation, e.g., sale of vehicle, switching to a

different insurance provider, etc.]. Please process the cancellation

at your earliest convenience and provide written confirmation of the

cancellation and any refund that may be due.

If there are any forms that need to be completed or any additional

information required from my end to facilitate the cancellation process,

please let me know promptly so that I can fulfill those requirements.

I would appreciate it if you could send any correspondence regarding

this cancellation to the address mentioned above.

Thank you for your attention to this matter. If you have any questions

or require further information, please do not hesitate to contact me at

[Your Phone Number] or via email at [Your Email Address].

Sincerely,

[Your Name]

The Importance of an Auto Insurance Cancellation Letter

In the realm of insurance, there is a crucial document that often gets overlooked but plays a significant role in the process – the insurance cancellation letter. This letter serves as a formal notification to your insurance provider that you wish to terminate your current policy. Understanding the importance of this seemingly mundane letter can save you from unnecessary complications down the road.

Why You Need an Auto Insurance Cancellation Letter?

- Legal Requirement: First and foremost, sending an insurance cancellation letter is often a legal requirement. Most states mandate that drivers must inform their insurance company in writing if they decide to cancel their policy. Failing to do so could result in penalties or fines.

- Avoid Coverage Gaps: By formally notifying your insurer of the cancellation, you prevent any gaps in coverage that could leave you vulnerable in case of an accident or other unforeseen circumstances. Without this letter, you may be held liable for damages even after you thought your policy was terminated.

- Documentation: Keeping a record of your insurance cancellation letter provides you with documentation of the cancellation, which can be valuable in case of disputes or misunderstandings with the insurance company.

How to Write an Auto Insurance Cancellation Letter

- Include Relevant Information: When drafting your insurance cancellation letter, be sure to include essential details such as your policy number, effective date of cancellation, reason for cancellation, and your contact information.

- Be Clear and Concise: Keep the letter clear and concise, avoiding unnecessary details. State your intention to cancel the policy in a straightforward manner to avoid any confusion.

- Request Confirmation: It’s a good practice to request written confirmation from your insurer acknowledging the receipt of your cancellation letter. This will serve as proof that the cancellation process has been initiated.

FAQ’s about Auto Insurance Cancellation Letter

Auto insurance is a crucial aspect of responsible vehicle ownership. However, there may come a time when you need to cancel your insurance policy. Understanding the process of cancelling your auto insurance through a formal letter is essential. In this blog post, we’ll delve into some frequently asked questions about auto insurance cancellation letters to guide you through this process smoothly.

Q1: What is an Auto Insurance Cancellation Letter?

An insurance cancellation letter is a written document that formally notifies your insurance provider of your decision to terminate your policy. This letter serves as a record of your intent to end the coverage and typically includes important details such as your policy number, effective date of cancellation, and reasons for discontinuing the policy.

Q2: Why Do I Need to Send an Insurance Cancellation Letter?

Sending an insurance cancellation letter is a crucial step to ensure a smooth termination of your policy. It provides both you and your insurance provider with a written record of the cancellation request, avoiding any misunderstandings or disputes in the future. Additionally, it allows your insurer to process the cancellation promptly and accurately.

Q3: What Should I Include in an Insurance Cancellation Letter?

When crafting your auto insurance cancellation letter, make sure to include the following essential information:

- Your full name

- Policy number

- Effective date of cancellation

- Reason for cancelling

- Request for confirmation of cancellation

Q4: How Do I Write an Effective Insurance Cancellation Letter?

Writing an effective auto insurance cancellation letter involves being clear, concise, and professional. Here are some tips to help you craft a compelling letter:

- Start with a polite greeting and address your insurance provider directly.

- Clearly state your intention to cancel the policy and provide all necessary details.

- Explain the reason for cancellation briefly but honestly.

- Request confirmation of the cancellation in writing for your records.

Pro Tip: Keep a copy of the cancellation letter for your records and send it via certified mail to ensure it is received by your insurer.

Q5: What Happens After I Send the Insurance Cancellation Letter?

Once you send the cancellation letter to your provider, they will process the request and send you a written confirmation of the policy cancellation. It’s essential to review this confirmation carefully to ensure all details are accurate. Remember that you may be entitled to a refund of any unused premiums after the effective date of cancellation.

Conclusion

Sending an auto insurance cancellation letter is a straightforward process that requires attention to detail and effective communication. By following these FAQs and tips, you can navigate the cancellation process with confidence and ensure a seamless transition out of your current policy. Remember, staying informed and proactive is key to managing your auto insurance effectively. If you have any further questions or need assistance, don’t hesitate to reach out to your insurance provider for guidance.

Drive safely!