Writing an insurance cancellation letter is a key step in formally ending your policy. Make sure to include all necessary information, keep the letter concise and clear, and follow up with the insurance company to confirm cancellation.

Canceling an insurance policy can be a daunting task, but it doesn’t have to be complicated or stressful. Understanding the process of drafting an insurance cancellation letter can help you navigate this situation smoothly. In this blog post, we will walk you through the steps of creating an effective insurance cancellation letter, providing you with the confidence to terminate your policy when needed.

How to Write an Insurance Cancellation Letter

Writing an insurance cancellation letter involves several key components to ensure that your message is clear and that the cancellation process goes smoothly. Here’s a breakdown of how to craft an impactful insurance cancellation letter:

1. Contact Information

Start by including your full name, address, policy number, and contact information at the top of the letter for easy identification by the insurance provider.

2. Date and Recipient Information

Include the date and the name of the insurance company’s representative or department to whom the letter is addressed. This ensures that your request reaches the right person promptly.

3. Reason for Cancellation

Clearly state the reason for canceling your insurance policy. Whether it’s due to finding a better rate elsewhere, no longer needing the coverage, or any other reason, honesty is crucial.

4. Policy Details

Provide specific details about the policy you wish to cancel, including the policy number, coverage type, and effective date of the cancellation. This information helps the insurance company locate your account quickly.

5. Request for Confirmation

Politely request confirmation of the cancellation in writing from the insurance company. This serves as a formal acknowledgment of your request and helps avoid any misunderstandings in the future.

Tips for Writing a Effective Insurance Cancellation Letter

When crafting your insurance cancellation letter, keep the tone friendly and professional to maintain a positive relationship with the insurance provider. Here are some tips to ensure your letter is well-received:

+ Be Polite and Respectful

Use polite language throughout the letter, even if you are unhappy with the service or coverage. Maintaining a respectful tone can go a long way in fostering good communication.

+ Keep It Concise

Be concise and to the point when explaining the reason for cancellation and providing policy details. Avoid unnecessary information that may confuse the recipient.

+ Offer Feedback (If Applicable)

If there is a specific reason for canceling that could be addressed by the insurance company, consider offering constructive feedback. This may help improve their services for other policyholders in the future.

+ Express Gratitude

Express gratitude for the coverage provided during your time as a policyholder, even if you are choosing to cancel. A simple thank you can leave a positive impression.

Sample Insurance Cancellation Letter Template

Here are few Insurance cancellation letter samples:

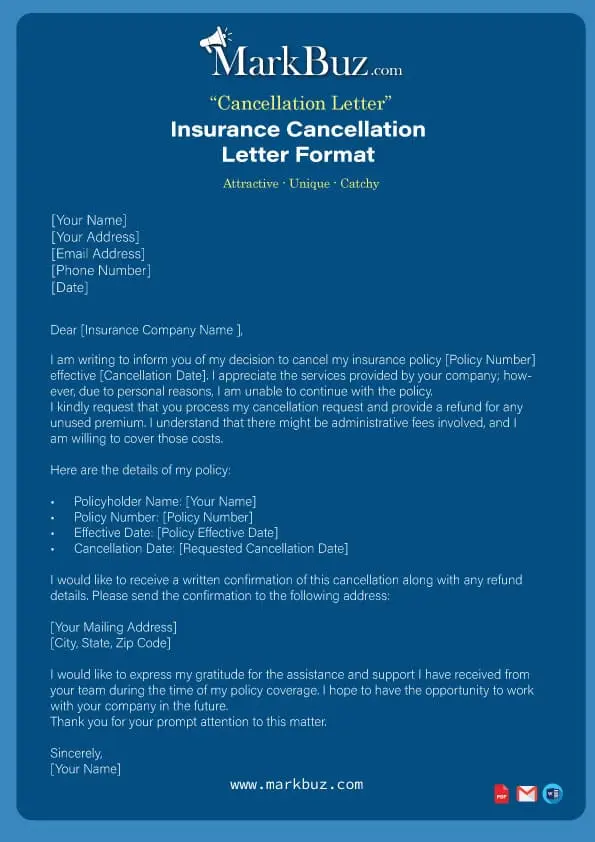

Example 1:

[Your Name]

[Your Address]

[Email Address]

[Phone Number]

[Date]

Dear [Insurance Company Name],

I am writing to inform you of my decision to cancel my insurance

policy [Policy Number] effective [Cancellation Date]. I appreciate

the services provided by your company; however, due to personal

reasons, I am unable to continue with the policy.

I kindly request that you process my cancellation request and

provide a refund for any unused premium. I understand that there

might be administrative fees involved, and I am willing to cover

those costs.

Here are the details of my policy:

Policyholder Name: [Your Name]

Policy Number: [Policy Number]

Effective Date: [Policy Effective Date]

Cancellation Date: [Requested Cancellation Date]

I would like to receive a written confirmation of this cancellation

along with any refund details. Please send the confirmation to the

following address:

[Your Mailing Address]

[City, State, Zip Code]

I would like to express my gratitude for the assistance and support

I have received from your team during the time of my policy coverage.

I hope to have the opportunity to work with your company in the future.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

Example 2:

[Your Name]

[Your Address]

[Email Address]

[Phone Number]

[Date]

Dear [Insurance Company Name],

I am writing to formally request the cancellation of my

insurance policy with [Insurance Company Name]. Please

consider this letter as a formal notice of my intent to cancel

my policy effective [date you want the cancellation to be

effective], in accordance with the terms and conditions outlined

in the policy agreement.

Details of the policy: Policyholder Name: [Your Name] Policy Number:

[Your Policy Number] Type of Insurance: [Type of Insurance,

e.g., Auto, Home, Health] Effective Date of Policy: [Effective Date]

I would like to cancel the aforementioned policy due to [reasons for

cancellation, e.g., change in circumstances, switching to a different

insurance provider, etc.]. Please process the cancellation at your

earliest convenience and provide written confirmation of the

cancellation and any refund that may be due.

If there are any forms that need to be completed or any additional

information required from my end to facilitate the cancellation

process, please let me know promptly so that I can fulfill

those requirements.

I would appreciate it if you could send any correspondence regarding

this cancellation to the address mentioned above.

Thank you for your attention to this matter. If you have any questions

or require further information, please do not hesitate to contact me at

[Your Phone Number] or via email at [Your Email Address].

Sincerely,

[Your Name]

Common Reasons for Cancelling Insurance

When it comes to insurance, there are various reasons why individuals may choose to cancel their policies. Understanding the common reasons behind insurance cancellation can provide insights into the factors that influence these decisions. Let’s explore some of the key reasons why individuals may choose to cancel their insurance policies.

Changes in Financial Situation

- Job Loss – Unforeseen circumstances such as job loss can significantly impact an individual’s financial stability, making it challenging to afford insurance premiums.

- Financial Hardship – During times of financial hardship, individuals may prioritize essential expenses over insurance payments, leading to policy cancellation.

- Income Reduction – A decrease in income can make it difficult for individuals to maintain their existing insurance coverage, prompting them to cancel their policies.

Better Coverage Options

- Competitive Rates – Individuals may cancel their insurance policies if they find better coverage options with more competitive rates from other insurance providers.

- More Comprehensive Policies – Some individuals may opt to cancel their current policies in favor of more comprehensive coverage that better meets their needs.

Life Changes

- Relocation – Moving to a new location can impact insurance rates, prompting individuals to cancel their current policies and seek coverage in their new area.

- Marital Status Change – Significant life events such as marriage or divorce can influence insurance needs, leading individuals to cancel their existing policies.

- Vehicle Change – Upgrading or downsizing a vehicle may require adjustments to insurance coverage, resulting in policy cancellation.

Dissatisfaction with Services

- Claims Process – Difficulties with the claims process or unsatisfactory claim outcomes can lead individuals to consider canceling their insurance policies.

- Customer Service – Poor customer service experiences may prompt individuals to switch insurance providers or cancel their policies altogether.

FAQ’s About Insurance Cancellation Letter

When it comes to insurance, understanding the process of cancellation is just as important as purchasing the policy itself. In this blog post, we will cover the frequently asked questions about insurance cancellation letters to help you navigate this often confusing aspect of insurance.

Q1: What is an Insurance Cancellation Letter?

An insurance cancellation letter is a formal document sent by either the policyholder or the insurance provider to terminate an existing insurance policy. This letter serves as a written record of the request to cancel the policy and outlines important details such as the effective date of cancellation and any refunds due.

Q2: Why Would I Need to Send an Insurance Cancellation Letter?

There are various reasons one might need to send an insurance cancellation letter. Some common scenarios include finding a better insurance deal elsewhere, no longer needing the coverage, or dissatisfaction with the current policy terms or customer service.

- It is crucial to be aware of the terms and conditions outlined in your insurance policy regarding cancellation procedures.

- Always remember to request confirmation of the policy cancellation in writing to avoid any future misunderstandings.

Q3: How Do I Write an Effective Insurance Cancellation Letter?

Writing an insurance cancellation letter can be a straightforward process if you follow these essential steps:

- Begin with a clear statement: Start your letter by clearly stating that you wish to cancel your policy.

- Provide policy details: Include your policy number, effective dates, and any other relevant information.

- Specify the reason: Briefly explain why you are canceling the policy.

- Request confirmation: Politely request written confirmation of the cancellation.

- End on a professional note: Close the letter with a courteous closing.

Q4: Can I Cancel My Insurance Policy Anytime?

Most insurance policies allow for cancellation at any time, but there may be certain implications to consider:

- Early Termination Fees: Some policies may require you to pay a fee for canceling before the policy term ends.

- Refund Policies: Depending on the terms of your policy, you may be eligible for a partial refund of premiums paid.

Conclusion

Crafting a well-written insurance cancellation letter is a crucial step in ensuring a smooth and hassle-free cancellation process. By following the guidelines provided in this blog post, you can effectively communicate your decision to terminate your auto insurance policy. Remember to keep your letter concise, clear, and professional in tone to convey your message effectively.

“Writing an insurance cancellation letter is a simple yet essential task that can help you manage your insurance policy effectively.”